New possibilities form more offline retail data.

Michael Norris

Catégorie : Mobile Wallets

Michael Norris, China Consumer and Tech Trend Researcher in Curio and AgencyChina, researches and consults how China’s economic, societal and technological changes affect business and consumer strategy.

China’s e-commerce market continues to post impressive year-on-year growth, but patchy penetration across different product categories and increasingly expensive user acquisition has prompted some businesses to re-examine their physical retail presences and how they form a ‘single customer view’ across online and offline channels.

As a firm dedicated to connected loyalty marketing on and offline delivering revenue and profit across every channel, Splio is keeping a watching brief on the changes New Retail is bringing to customer relationship management and loyalty programs. With a tip of the hat to Jack Ma, we’ve dubbed this New Loyalty.

New Loyalty entails a number of different concepts. One of these is Physical Retail e-Commercification.

That’s mouthful, so let us explain what that means.

e-Commerce provides a vast array of data on consumers’ visiting, browsing and buying behavior – everything from the time spent on page, to what product photos were viewed, to the time from consideration to purchase is all measured, stored and analyzed.

By contrast, physical retail outlets are the equivalent of a data black hole: beyond foot traffic measurements and transaction data, physical retailers don’t have a great deal of access to robust, granular data on the customers, potential customers and window-shoppers who enter their stores.

New Retailers are working hard to change this dynamic.

New Retailers, forward-thinking brands and mall owners are trying to collect more data in physical retail locations and connect that data to what they know about customers through other channels.

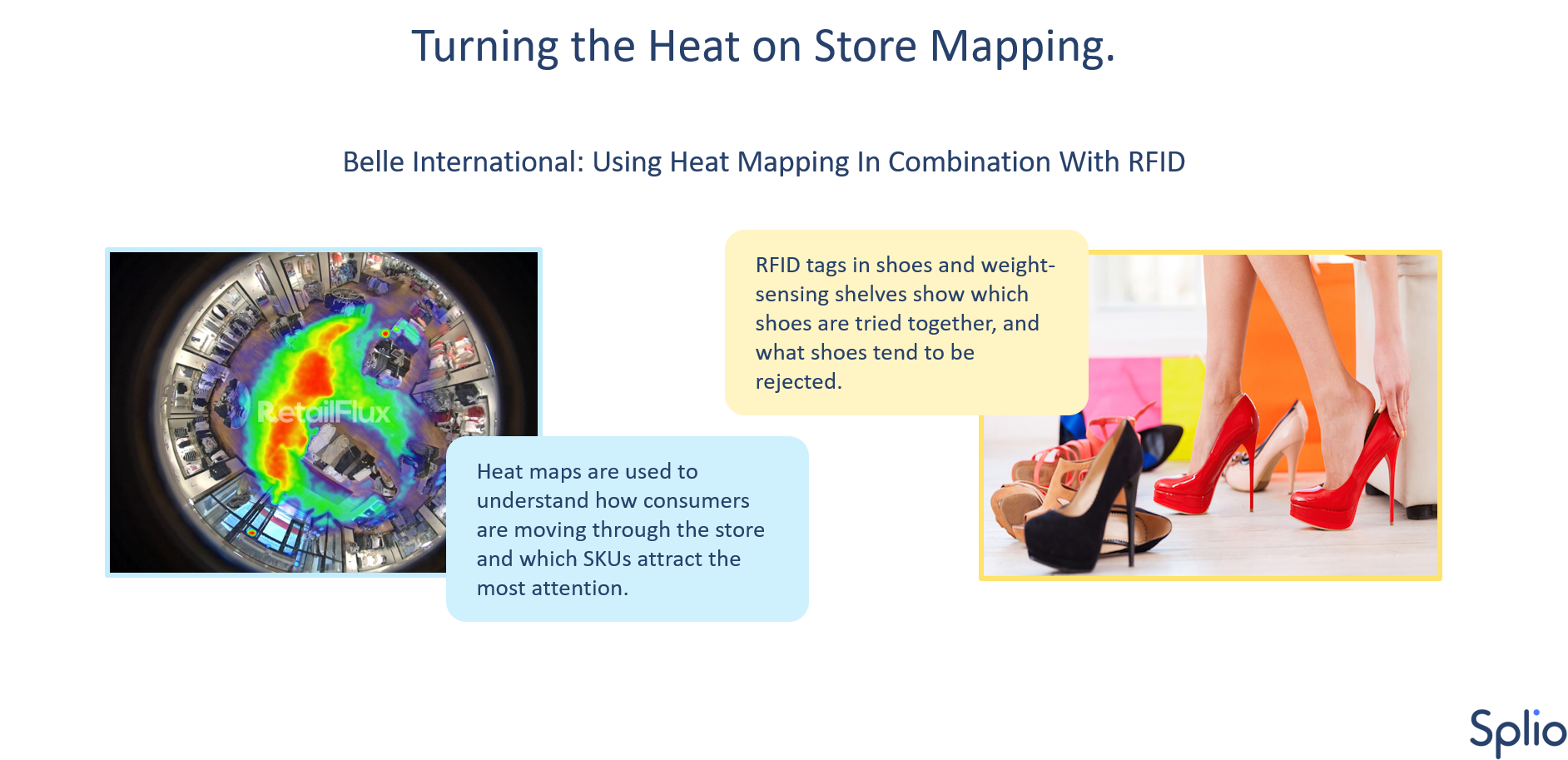

Aside from membership-first, purchase later loyalty programs, we’re seeing deployments of heat maps, facial recognition technology and geo-location technology to close the gap between e-commerce and physical retail store data.

All this is going towards identification of individual shoppers across channels, better data and sophisticated analytics.

One of the best proponents of this is Belle International. Belle is the top shoe retailer in China. They’ve deployed heat maps in their stores to understand how customers move around the store, interact with products and in-store displays. This adds much-needed science to in-store merchandising that has traditionally been done by gut feel and observation.

More interestingly, Belle uses RFID (Radio Frequency IDentification) tags on shoes displayed in-store and in floor mats where shoes are tried on. That allows Belle to work out what shoes are tried on together, as which shoes have high conversion and rejection rates. These insights are particularly useful at the start of a season, where Belle can receive early feedback on how new SKUs perform.

All this is leading to more data and increasing quantification of in-store visits. While more data sounds like a valuable asset, the asset’s value is only realized if that data is turned into insight and is acted on as part of strategic and operational decision-making. To understand what New Retailers in China are doing and how your organization can improve its collection and use of customer data, scan the QR code bellow to download Splio’s latest deck on loyalty in the New Retail context.

*Splio would like to thank Michael Norris for his contribution in the creation of this guide together with Splio team.

{{cta(‘4298aa28-7374-453a-b0a4-3e1796269c35’)}}

To get regular insights on how to develop and strengthen your Loyalty strategy in China, scan the QR code to follow us on WeChat!

Sommaire